The Vancouver housing market notched a 46% year-over-year increase in sales activity for the month of October. This marks four consecutive increases in sales volumes on an annualized basis.

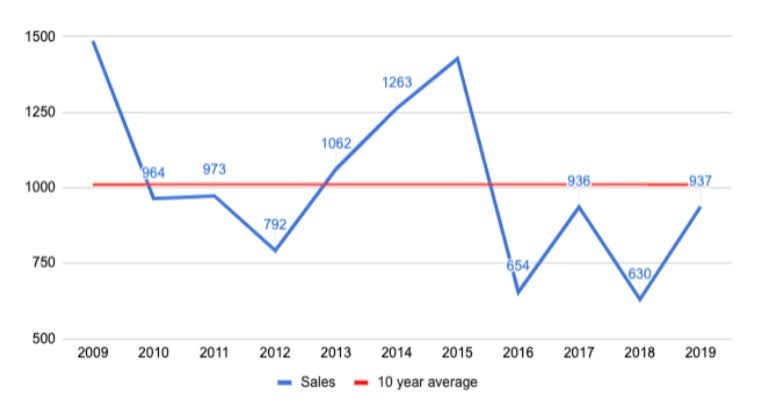

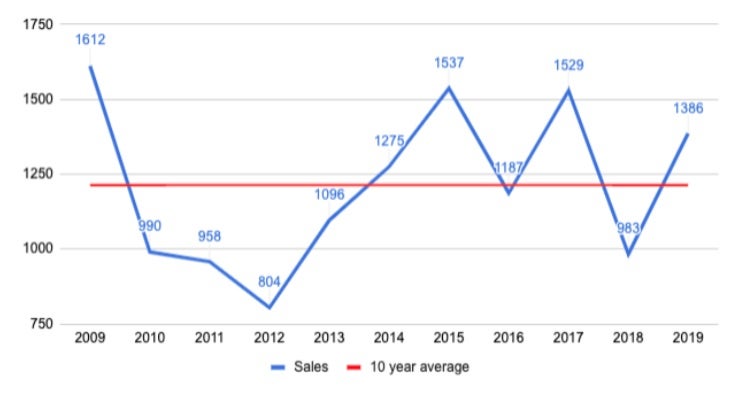

Detached Sales

Detached sales surged 48% from last year. Sales picking up as sellers adjust their prices lower and buyers come off the sidelines.

However, because of affordability issues, most of the increase in detached housing activity is concentrated in the lower end, more affordable segments. In some cases I am seeing multiple offers for entry level detached houses with basement suites. Meanwhile the high end of the detached market continues to suffer.

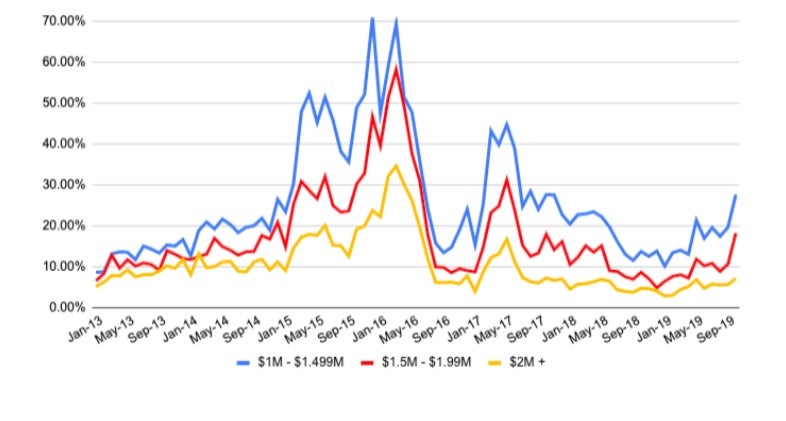

Detached Sales to Actives Ratio by Price Range

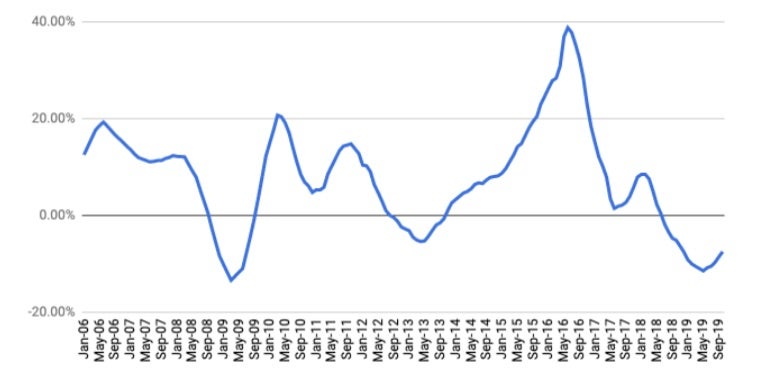

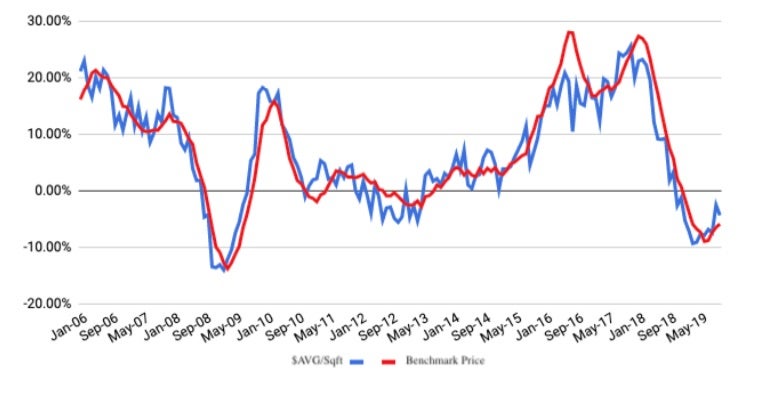

Detached Prices Year Over Year

Detached Inventory

The Condo Market

Condo Sales for October

Condo Annual Price Change

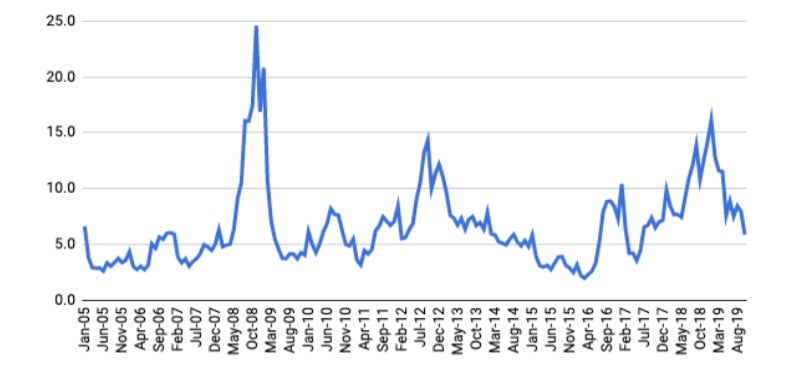

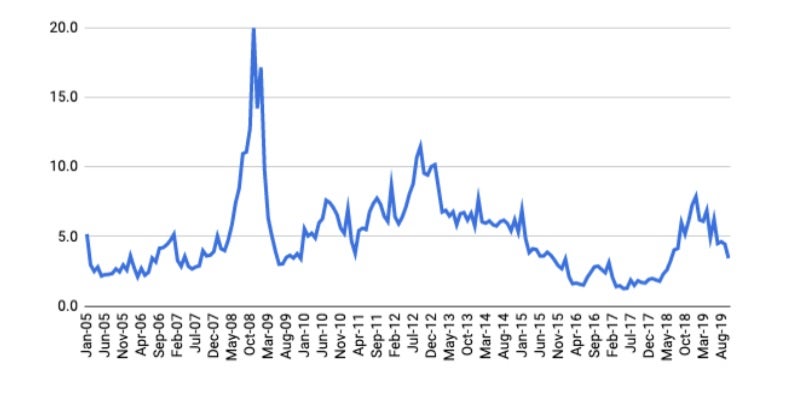

The main reason condo price declines are easing is a decline in inventory. Inventory growth was trending higher for the past year but has since reversed in recent months due to rising sales and a decline in new listings as sellers hold off from listing their units. As of the end of October there was just 3.4 months of inventory for sale. It is close to impossible to see a sustained decline in prices when inventory is in this range. It needs to grow above 5 or more to see downwards pressure on prices.

Condo Months of Inventory

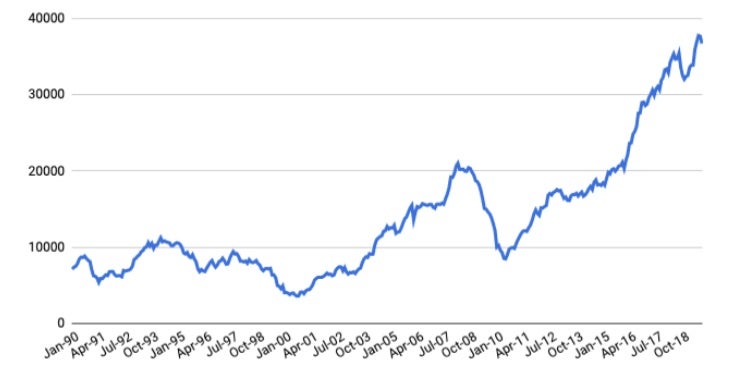

Despite the decline in inventory we still believe months of inventory should turn higher in the year ahead given there is a record number of new condo units under construction, and we expect completions to begin ramping up next year.

Condos Under Construction

In summary I find the condo market is in good shape. Entry level condos are once again fetching multiple offers but as soon as prices start to creep up we are seeing some softness. Overall, inventory remains low, and this is keeping prices relatively flat for now. I suspect inventory could actually fall further in the winter months before eventually turning higher once again in the New Year.

In summary I find the condo market is in good shape. Entry level condos are once again fetching multiple offers but as soon as prices start to creep up we are seeing some softness. Overall, inventory remains low, and this is keeping prices relatively flat for now. I suspect inventory could actually fall further in the winter months before eventually turning higher once again in the New Year.Summary

October brought another positive month for the Vancouver housing market. The increase in sales activity and moderation in price declines has eased concerns over a potentially ugly downturn. However, to suggest it is smooth sailing from here is rather premature and there are still risks to the downside. Indeed financial vulnerabilities still exist and so too does the mortgage stress test following the re-election of the Liberal Government. Now we are left wondering if the Trudeau Government will indeed follow through with campaign promises which included a nationwide 1% annual empty homes/ speculation tax and an expansion of the first time home buyer incentive program in Vancouver, Victoria and Toronto. If the program expands in Vancouver it could arguably make supply issues worse. The program proposes to increase eligibility up to a maximum purchase price of $790,000. As of the end of October there was just 2.7 months of inventory for sale for homes in Greater Vancouver below $790,000. Adding more demand (Government subsidized loans) at this point would only go to benefit the sellers in the form of higher prices.The loan could, however, provide a boost to property developers who are still enduring a sluggish pre-sale market. Investors, who are a key factor in driving sales at pre-sale centres, have been skittish to return. Developers are proceeding with caution, and job layoffs have been noted. Will this begin to weigh on the BC economy? One would think so. Recent data from Stats Canada shows the BC labour market has contracted for four consecutive months as of the end of September, the first time doing so since 2012/2013. About 9% of the BC workforce is employed directly in construction so this is an important space to watch moving forward.